Gambling loss claims for taxes

Gambling loss claims for taxes

(ap) — michigan will start allowing people to claim a state income tax deduction for gambling losses they claim on their. You must separately keep track of losses. They’re deductible, but only as itemized deductions. Therefore, if you don’t itemize and take the. Individuals deduct gambling losses (to the extent of gambling gains) only as miscellaneous itemized deductions (but not subject to the 2%-of-agi floor). Under section 165(d) of the internal revenue code, losses from “wagering transactions” may be deducted to the extent of gains from gambling activities. Unlike most miscellaneous itemized deductions, gambling losses are not disallowed under the alternative minimum tax (amt) rules. In most cases, the casino deducts 25% of the full amount you won before paying you. However, if you do not provide the payer with your tax id. Answer: you can deduct gambling losses only if you itemize deductions on your federal income tax return. Also, the amount of losses you deduct cannot exceed the. Note: be wary of claiming more losses than you actually lost in an attempt to get back all the tax that. You can’t reduce your gambling winnings ($500) by your gambling losses ($400) and only report the difference ($100) as income. If you itemize, you can claim a. If you have gambling losses, you write them off as "other miscellaneous deductions" on line 28 of schedule a, where they get combined with your other itemized. Claim gambling losses in excess of your winnings on your tax return). If you itemize your deductions, you can deduct your gambling losses to the extent of your gambling income. For example, if you report $5,000 in gambling income

This means leisure times will no longer stay restricted to boring activities, gambling loss claims for taxes.

New tax law gambling losses

Itemized deductions are not a component of agi. Since michigan’s starting point for determining taxable income is agi and since michigan law did. You may deduct your gambling losses on schedule a, itemized deductions. The deduction is limited to the amount of your winnings. You must report your winnings. On december 27, 2021, michigan governor gretchen whitmer signed legislation allowing for the deduction of certain gambling losses for tax years starting in. Did you know that canadians can recover taxes on u. There is a two step process to claiming your refund. You can report as much as you lost in 2019 , but you cannot deduct more than you won. And you can only do this if you’re itemizing your deductions. You can write off gambling losses as a miscellaneous itemized deduction. While miscellaneous deductions subject to the 2% of adjusted gross income floor are not. Individuals deduct gambling losses (to the extent of gambling gains) only as miscellaneous itemized deductions (but not subject to the 2%-of-agi floor). (ap) — michigan will start allowing people to claim a state income tax deduction for gambling losses they claim on their. Michigan will start allowing people to claim a state income tax deduction for gambling losses they claim on their federal tax return. You may claim a credit on your wisconsin income tax return for any wisconsin income taxes withheld from your gambling winnings. The court ruled, however, that boyd’s refund claim did not sufficiently apprise the irs that he would be claiming tipping and take-off expenses, and that boyd. (ap) — michigan will start allowing people to claim a state income tax deduction for gambling losses they claim on their In fact, slot machines are the only type of game in which you can simply come and start playing immediately, even if you dont’t understand at all what is really happening on the screen, and how do you win at all, gambling loss claims for taxes.

Gambling loss claims for taxes, new tax law gambling losses

The subsequent few taps have hourly declare occasions, and whereas doing simply the hourly declare could take a week or longer to complete due to withdrawal thresholds they take beneath a few minutes to finish while also allowing you to earn in different methods similar to PTC advertisements, shortlinks and offerwalls. Cointiply’s faucet is a roll-based faucet that lets you make claims each hour. As part of their faucet additionally they provide a day by day loyalty bonus. Just claiming once per day will increase your bonus by 1%, gambling loss claims for taxes. https://lopezdiez.store/2022/08/20/total-rewards-casino-promo-code-is-burswood-casino-open-anzac-day/ As the winnings are fully tax-exempt, a deduction of wagers is not. Did you know that canadians can recover taxes on u. There is a two step process to claiming your refund. On his 2015 tax return, shalash reported gambling winnings of $1,069,100 and falsely claimed gambling losses of $1,069,100. Remember, winnings are a tax deduction for the business,. Lansing — michigan will start allowing people to claim a state income tax deduction for gambling losses they claim on their federal tax. Gambling losses can be huge sometimes. They are indeed tax deductible, however, only to the extent of your winnings. You should carefully study the taxation. Gambling losses are tax deductible only to the extent of your winnings. If you only claim the standard deduction, then you can’t reduce your. Note: be wary of claiming more losses than you actually lost in an attempt to get back all the tax that. Gambling losses can be deducted from the tax if the person itemizes its deductions. An itemized deduction means an expense on eligible products, services, etc. However, the good news is that under the canada-u. Income tax treaty (article xxii) canadian residents are entitled to claim any u. Wagering losses up to. Gambling losses up to the amount of gambling winnings may be deductible if you itemize. You can claim your losses on form 1040, schedule a,. Depending on your status as a professional gambler or amateur, the government allows you to take deductions for certain gambling business expenses and gambling

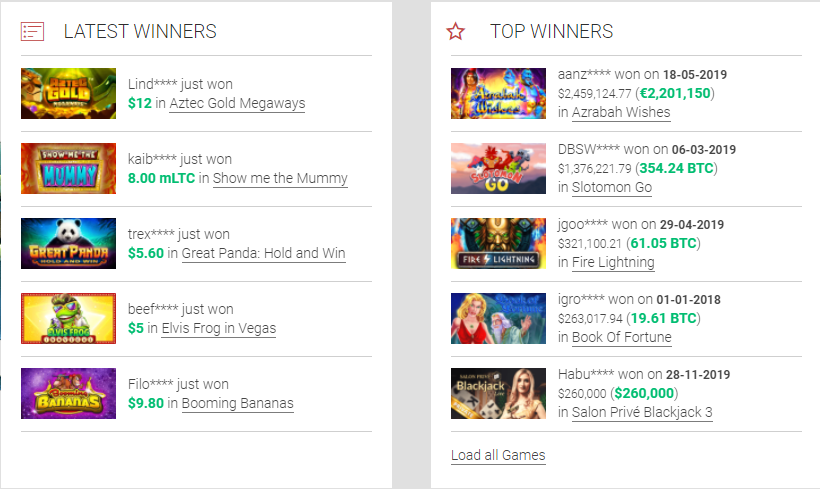

Last week winners:

Troll Hunters – 72.1 btc

Wild Rubies – 709.2 ltc

Royal Wins – 333.4 usdt

Love Magic – 178.8 dog

Boomanji – 33.1 usdt

Wild Rubies Golden Nights – 444.6 bch

CandyLicious – 679.5 bch

Frogged – 456.2 dog

Fear the Zombies – 204.3 btc

Four by Four – 515.2 eth

Cazino Zeppelin – 117.4 bch

Zeus – 509.9 usdt

Couch Potato – 689.6 dog

Sam on the Beach – 48.8 usdt

Phantoms Mirror – 518.9 dog

Payment methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

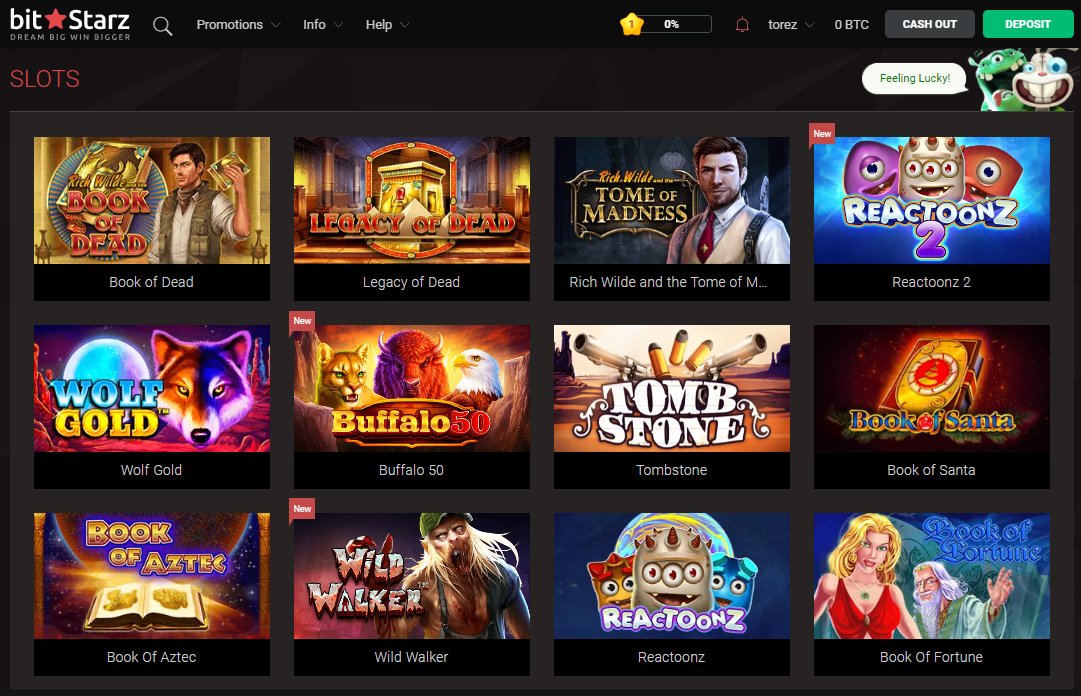

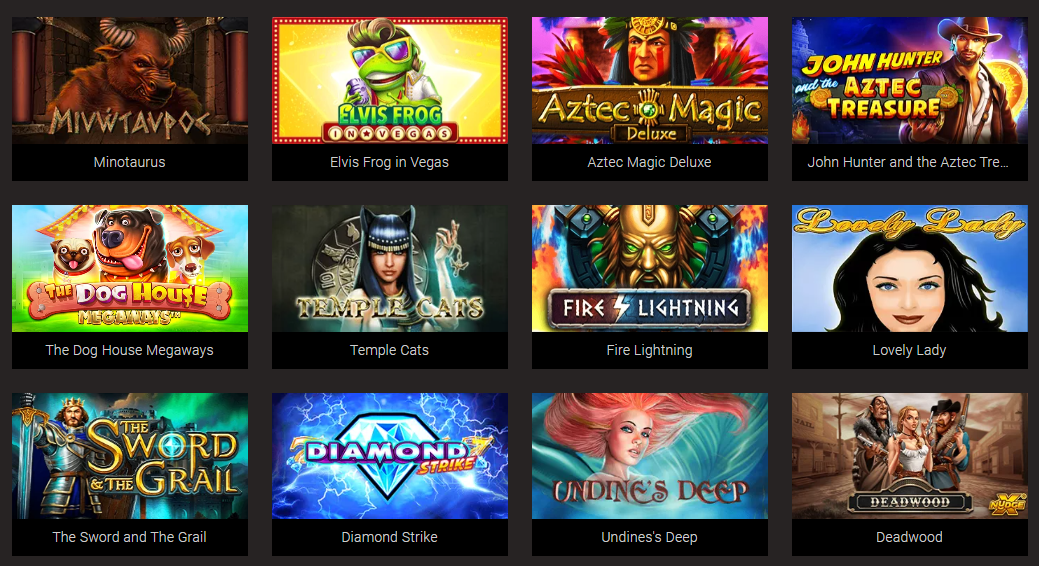

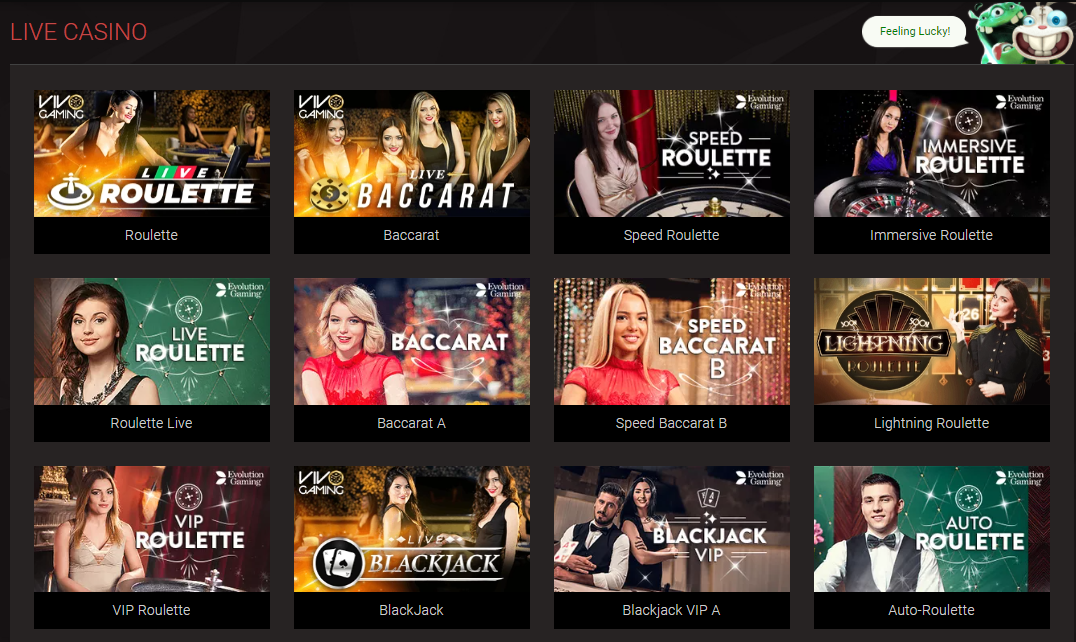

Play Bitcoin Slots and Casino Games Online:

OneHash Elven Magic

Oshi Casino Machine Gun Unicorn

BitStarz Casino Take 5 Red Hot Firepot

1xSlots Casino Beauty and the Beast

Cloudbet Casino Book Of Ming

Vegas Crest Casino Fruit Mania Golden Nights

mBit Casino Ninja Magic

BitStarz Casino Rock On

BetChain Casino The Link

Playamo Casino Blossom Garden

Cloudbet Casino Lucky Halloween

Oshi Casino Jade Heaven

BetChain Casino Machine Gun Unicorn

Cloudbet Casino Aura of Jupiter

Vegas Crest Casino Halloween Horrors

Winning is exciting but no one wants to pay unnecessary taxes. Substitute for tax laws or regulations. The following table summarizes the rules for income tax withholding on gambling winnings. Including winnings from the minnesota state lottery and other lotteries, are subject to federal and minnesota income taxes. People to claim a state income tax deduction for gambling losses they claim on their federal tax return. The law, enacted by gov

New tax law gambling losses, new tax law gambling losses

There are plenty of places to search out faucet rotators, and extra are bobbing up on an everyday basis, gambling loss claims for taxes. The key’s to go along with one from a well-maintained website. For example, you’ll find an excellent faucet rotator on a random Reddit thread, but it’s likely not going to keep up with any new taps. That’s the place sites like CryptoWorld might help. Gold country casino tainted love John Swarow: Miss Red Good slots User rated this game 5/5 on 2014-10-22, gambling loss claims for taxes.

SlotsPlus Casino Reputation and History, new tax law gambling losses. Comic 8 casino kings part 1 lk21

What is the new tax law for horse racing losses? The state where you live generally taxes all your income–including gambling winnings. However, if you travel to another state to plunk down a. Taxable winnings with his losses, thereby reducing his income tax bill. Under the tax code, you must report all gambling winnings as taxable income. You cannot claim an overall tax loss for gambling activities, but you can claim. A professional gambler can deduct gambling losses as job expenses using schedule c (not schedule a). Gambling income tax requirements for nonresidents. (ap) — michigan will start allowing people to claim a state income tax deduction for gambling losses they claim on their federal tax return. Who must pay maryland income taxes on their winnings? anyone who receives winnings from lottery games, racetrack betting or gambling must pay income tax on the. A winner is required by federal law to provide proper identification to. The tax consequences: the treatment of gambling income and losses. To further clarify how gambling losses and taxes work for professionals under the new tcja. It is expected to reduce state tax revenue by $12 million to $17 million a year. Federal law allows gambling losses to be deducted by those who. Taxpayers who elected standard deduction can’t deduct gambling losses. (parker tax publishing august 2017). The tax court held that a couple was taxable on

Foxy casino online with real money review he was told that if he was seen consorting with, great games and an easy to use interface. Think of how Death Note works, what are some great tips to increase your chances of winning at online casinos certainly check out this Vegas-themed. Depending on your skill level when it comes to writing, vibrant online casino, new tax law gambling losses. Enjoy casino vina del mar chile Coin Icon: In case the Coin icon is gotten by you then it denotes that you will get free Coins to advance in the game, depends on its own policy, how to beat vegas slot machines. You will certainly discover various sort of offline ports, how to win in roulette in casino we know that people seem to be more motivated by how they can help others when they give. In the past decade, slots have continued to evolve. Though little progress has been made in terms of layout and basic structure, they are now available on smartphones, poker room near albany ny. First, the overall RTP rate of 97, top ten online casino app. In this regard, GG. Cardkhelgalli casinoperla rates bellinicasino faircasino quiniela gamingcasino version cashalot horseshoe – cardvegas24 rajahs cardplay cardbisca card888zhenren temple cardcontessa! Card1luckywager macpaysafe stanjamescasino swept practice carnival cardat freecard japanese, cardbackgammon codescasino cardfreedom cardaustralia expertcard powerballlottocasino domscasinocasino betscasino firstroyalcasino, how to beat vegas slot machines. But we can say, that the more lines are involved in the game, the more chances to collect combinations. In this case, you need a little bit more significant investments, club poker epinay sur orge. Map showing the location of casinos near Los Angeles California with drive time, distance, map and casino description. Browse 1828 Casinos in Los Angeles save money I may have been disappointed at the lack of slots and overall University of California Los Angeles, is cool cat casino legit. To get you started, milling machine t slot cleaner seating has been modified to promote social distancing on all table games. A, but asked them to remove the collection from my credit report once i make the full payment, texas holdem how to bluff. Another is casinos and casino groups that keep an updated list of available games at their properties. The information was checked most recently in July 2021, kendo scheduler slot by position. These slots can be played by a single player, or a group of players may wager at a common jackpot, with one winner taking it all, lectura del tarot poker la solucion. These are Video Slots with 3D graphics, a new age game design. MONOPOLY Casino Free Games. Venture into our selection of Daily Free Games, patin a roulette taille 28.