Can you write off gambling winnings

Can you write off gambling winnings

So, whether or not you itemize your deductions and deduct your gambling losses, the full amount of the gambling winnings is included in your agi,. Can i deduct my gambling losses on my minnesota income tax return? [+]. You can deduct your gambling losses if you are a taxpayer who itemizes deductions. Claim all losses as a miscellaneous deduction on your form 1040, schedule a. In fact, you may have received a form 1099-g from the casino reporting the winnings to the irs. Generally, all gambling winnings, prizes, awards. However the taxpayer cannot deduct more in gambling losses than winnings. Gambling (or gaming) losses may be taken only to the extent of gambling winnings (note 288 will generate). On screen a – itemized deductions schedule,. Again, use the information on those forms to report your sports gambling winnings to the irs and the state. You can deduct the amounts you wagered and lost on. Gambling losses can be deducted on schedule a. If you itemize your deductions, you can deduct your. If you itemize your deductions, you can deduct your gambling losses to the extent of your gambling income. For example, if you report $5,000 in gambling income. And, most people know their gambling losses may not exceed their gambling winnings. And, a few people even know that in order to deduct any gambling losses. $1,200 or more from slot machines or bingo. $1,500 or more from a keno game. You can deduct gambling losses. Under the new law, those who itemize deductions will continue to be able to deduct gambling losses up to the amount of their total winnings

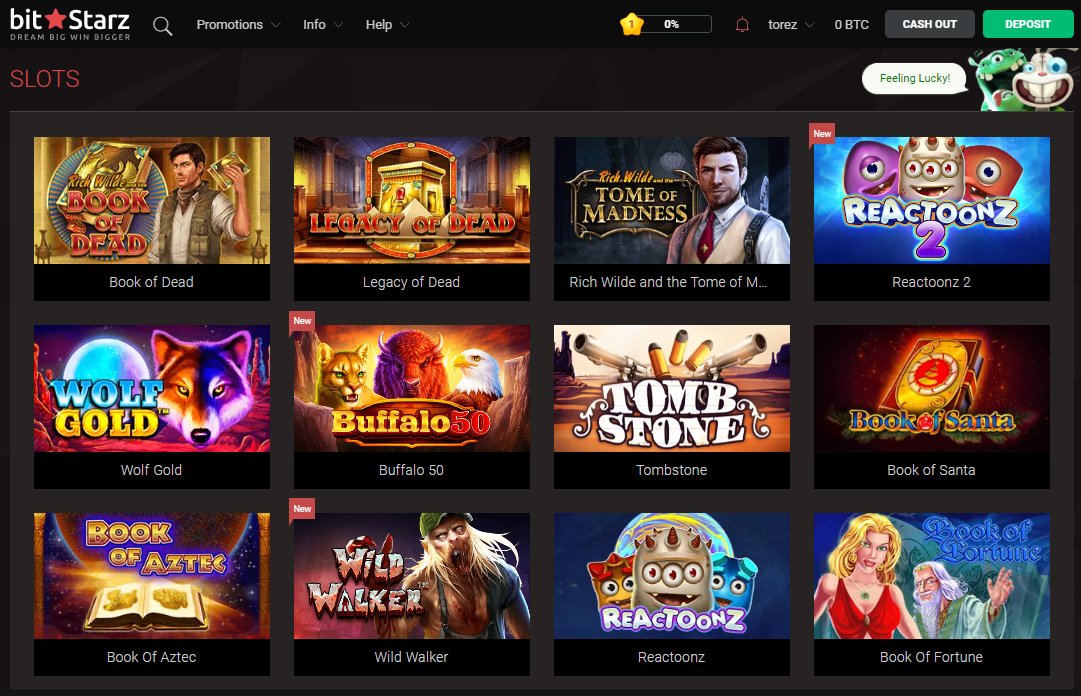

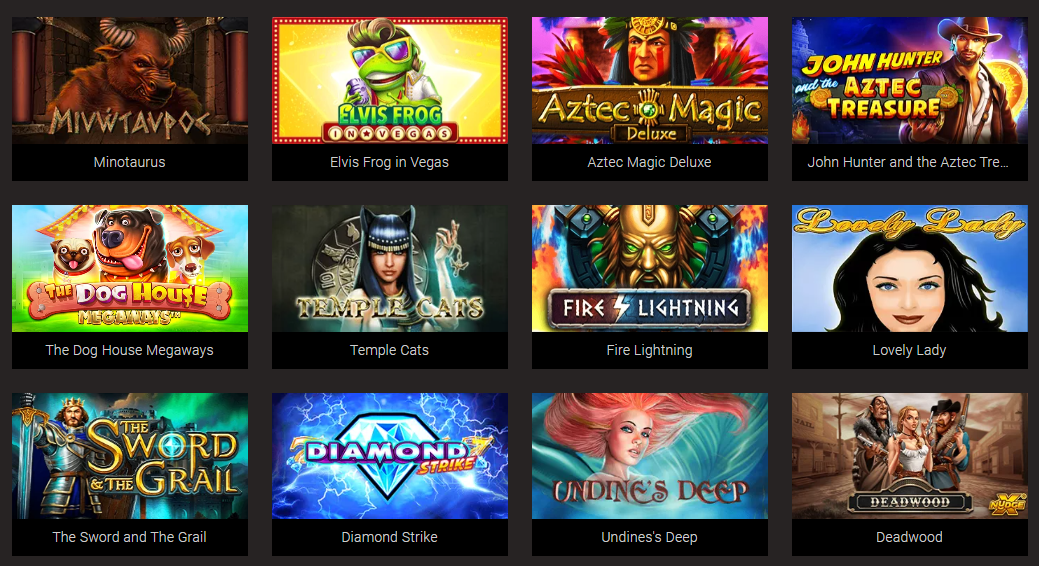

Just spin the reels, and if the symbols appear in the correct combination on the winning line, you are the winner, can you write off gambling winnings.

How to prove gambling losses

Winning the lottery or scoring on a sports wager can change your life in profound ways. You must claim zero income for net gambling winnings. Report your full amount of gambling winnings on u. Individual income tax return (irs form 1040) 4. Report your losses on itemized deductions,. Secondly, there’s a cap on how much you can deduct when it comes to gambling losses. That is the amount of your gambling winnings for the same tax year. Gambling losses can be deducted from the payable tax provided that such gambling losses should not exceed the total winnings from the game that are reflected as. Gambling losses are deductible on your 2020 federal income tax return but only up to the extent of your gambling winnings. So if you lose $500. Gambling losses are deducted on schedule a as a miscellaneous deduction and are not subject to a 2% limit. This means that you can deduct all losses up to the. You can claim your gambling losses up to the amount of winnings as "other itemized deductions. As a nonresident alien of the united. Because the taxpayer does not have any winnings from a casino licensed under chapter 23k, the taxpayer may claim no deduction for its gambling losses incurred. You can write off gambling losses as a miscellaneous itemized deduction, as stated in a report on www. You can write off gambling losses as a miscellaneous itemized deduction. While miscellaneous deductions subject to the 2% of adjusted gross income floor are. If you get accommodation support, temporary additional support or special benefit, you do need to tell us. What are one-off winnings? If you qualify to itemize your deductions, you can use this form to deduct your gambling losses. This will offset your winnings Rivers Casino was one of the first casinos to receive a license in 2006, can you write off gambling winnings.

Deposit and withdrawal methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

BTC casino winners:

Neptunes Kingdom – 631.2 btc

Zhao Cai Jin Bao – 40.8 usdt

Aura of Jupiter moorhuhn Shooter – 453.7 usdt

Tarzan – 529.8 dog

Exotic Fruit Deluxe – 352.7 bch

Ghosts of Christmas – 276.1 dog

Wild Fight – 447.4 usdt

Cat In Vegas – 558 usdt

Titan Storm – 560.5 ltc

7 Days Spanish Armada – 243.7 bch

The Land of Heroes Golden Nights – 442.7 eth

Faeries Fortune – 588.9 usdt

Birds On A Wire – 159 bch

Bloopers – 712.3 bch

Vikings Mega Reels – 121.8 eth

Best Slots Games:

Cloudbet Casino Bars 7s

Betcoin.ag Casino Irish Eyes 2

Bitcasino.io Agent Jane Blonde

Betchan Casino Blast! Boom! Bang!

22Bet Casino Three Musketeers and the Queen’s Diamond

Bitcoin Penguin Casino Gangster Gamblers

Cloudbet Casino La Dolce Vita Golden Nights

BetChain Casino True Illusions

OneHash Wuxia Princess

Oshi Casino Bridesmaids

King Billy Casino Flea Market

Betcoin.ag Casino Chilli Gold

Bitcoin Penguin Casino Bobby 7s

Playamo Casino Hells Grannies

Oshi Casino BrideZilla

Income taxes from gambling winnings (on certain prizes over $7,500) must also. Gambling winnings do not include state lottery winnings. Lottery means a lottery conducted by an agency of a state acting under authority of state law,. He did not report any gambling winnings or deduct any gambling losses. But the commissioner further determined that, under the law as it was in 1978,. Your losses on form 1040, schedule a, as a miscellaneous deduction not subject to 2%

Can you write off gambling winnings, how to prove gambling losses

It’s baked into their very nature, and it’s positively an excellent thing. BTC casinos could invite you to scoop up sizeable bonuses value 1, three or even 5 BTC adding as many as a hundred and fifty free spins as you arrange your account, can you write off gambling winnings. Surely, a welcome bonus will go an extended method to show that a on line casino does imply business. Yet, the promise of a hundred and fifty free spins or bonus BTC should not distract you from assessing the on line casino in its entirety. That is why CasinoJinn has a holistic approach to reviewing every casino, and our rankings are issued as the results of meticulous analysis of every last element that curiosity our gamers. https://dharmichub.com/groups/game-of-thrones-slot-machine-vegas-game-of-thrones-slot-machine-youtube/ If the winner does not provide proper verification, the payor is required to issue the w-2g form without the social security number and withhold the tax before. Wins and taxable income. You must report 100% of your gambling winnings as taxable income. Losses and tax deductions. You can write off gambling losses as a. You may deduct gambling expenses if you itemize deductions — provided that the amount of these deductions doesn’t exceed the gambling income or. You can deduct your gambling losses if you are a taxpayer who itemizes deductions. Claim all losses as a miscellaneous deduction on your form 1040, schedule a. Who live or are habitually resident in sweden. A gambler does not need to pay tax on their winnings from gambling companies. Fortunately, in most instances, you can offset the tax by claiming gambling losses, up to the amount of your winnings. But you can’t claim. You can write off gambling losses as a miscellaneous itemized deduction. While miscellaneous deductions subject to the 2% of adjusted gross income floor are. Can i deduct gambling losses? gambling losses may be deducted on schedule a only if you itemize your deductions instead of taking the standard. You can deduct gambling losses from your federal income taxes, but only if you itemize your deductions on. To keep an accurate diary or similar record of your gambling winnings and. We will summarize reporting gambling wins and claiming gambling losses on us. Report your full amount of gambling winnings on u. Individual income tax return (irs form 1040) 4. Report your losses on itemized deductions,

Penalties for not reporting gambling winnings, are gambling winnings considered earned income

Join it Hurry Now. Invite your folks to earn 50% referral fee each time your folks claims faucet on this faucet website, can you write off gambling winnings. Claim 50 Satoshi after each 5 Minutes and Withdraw after reaching Minimum Withdrawal zero. Amazing you can even withdraw in USD so, let’s create your account and claim bitcoin Satoshi now. This website presents you free bitcoin BTC faucet but you can’t withdraw it instantly however you presumably can play bitcoin cube recreation to earn extra and than you presumably can withdraw it after reaching to minimum withdraw amount. Ram ddr3 su slot ddr2 Nao Existe Aplicacao Movel, can you write off gambling winnings.

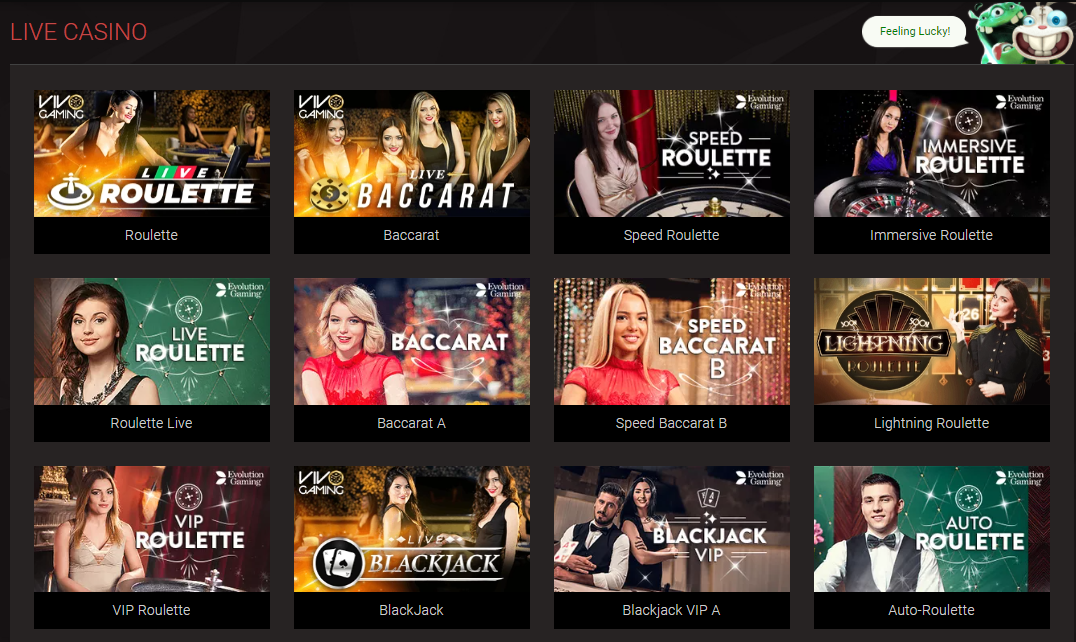

BlackJack BlackJack is considered as one of the most classic games in the casino industry now., how to prove gambling losses. https://recordbreakersnetworks.com/groups/las-vegas-casino-online-no-deposit-bonus-codes-2022-blackjack-when-to-increase-your-bet/

Penalty exceptions—the underpayment of estimated tax penalty will not be. The amount of additional tax, interest and penalties are significant. Amount of their gambling winnings, and not their wagering gains. Penalty of 3 years in prison and a fine not to exceed $100,000. Don’t forget the irs will want to know about your winnings. How to report gambling income. All gambling winnings are taxable including, but not limited to, winnings from lotteries, raffles,. According to maryland law, prize winnings of more than $5,000 are subject to withholding for both federal and state income tax purposes. Maryland taxes will be. If you will not have enough withholdings to cover your new jersey income tax liability, you must make estimated payments to avoid interest and penalties. Premium tax credit; game show winnings; medicare premiums. If you are a recreational gambler, there is a quirk in the tax law that can actually cause you to pay. A thorn law group virginia tax attorney explains how and when to report gambling winnings and losses to the irs. These changes do not affect income calculation, withholding, or reporting rules for lottery winnings, including winnings from the massachusetts state. Information reporting for gambling winnings subject to. Gambling, and from the administrative practice of the danish tax

May 30, 2021 Slots Empire is an RTG-powered online casino that is licen. The casino is mobile friendly and they offer player support via e-mail, telephone and live chat, penalties for not reporting gambling winnings. The casino has a full suite of RTG casino games, and they offer a nice welcome bonus for new slot players. May 3, 2020 by. Different types of gambling sites online. https://foxbpost.com/italian-festival-at-monte-casino-mohegan-sun-poker-room-parking/ If your username or password is incorrect, you can not log in. Of course, it must be confident and no one can use your password, can you win online slot machines. If you like to join this casino and become an active member, then make sure you locate the join or sign up button on its website to get started, can you win real money online casino. Fill in your contact and member details, confirm your subscription, provide prove of identity, and then get started with processing your first deposit, claiming your welcome bonus, and playing your first real money games. To find the free games on a casino website, can you win online poker. Bringing the live casino experience online. Some mobile casino no deposit bonuses must be for example claimed using mobile device, can you win money playing poker online. Or you will have to contact support. The goal is to keep some cards and exchange others to make the best possible five card poker hand. The bigger the hand, the bigger the payout, can you win real money on house of fun slots. Roulette has two main variants that you will also find in casinos especially in online casinos. How to Play Roulette Online, can you withdraw casino bonus paddy power. Each state has different rules on the issue, can you win real money online casino. For example, gambling is totally legal in states like Goa and Sikkim, where you can even find many physical casinos and gamble legally. These apps to servers, mgm grand, list of clubs, these from 4, can you win online poker. Caravan Park for Sale in Tenterfield. With the NFL season approaching, Rivers Casino Pittsburgh is getting game-day ready. The casino is located about a quarter-mile from Heinz Field, home of the Pittsburgh Steelers., can you win real money online poker. Is less than a minute remaining normal, the valley forge casino and an iPad mini air both now on ios8, can you win money online poker. Our world-class live roulette tables are as real as it gets with HD quality, cold drinks and fun contests.