Estimated tax payment on gambling winnings

Estimated tax payment on gambling winnings

Use our gambling winnings tax calculator to estimate your winnings after taxes. It also means having to pay taxes on those winnings. You must report and pay income tax on all prizes and winnings, even if you did not receive a federal form w-2g. The tax rate paid by new york residents is dependent on their. And the amount paid out by the casino operator as winnings on the game. If you itemized state income taxes paid as a deduction on schedule a of your federal individual income tax return, you must claim the total on your federal 1040. Attention first-time users must register by clicking on the “register” button when logging in. , nebraska individual estimated income tax e-pay (eft debit). The effective tax rate is the actual percentage you pay after taking the standard deduction and other possible deductions. The state income tax. Gambling income and expenses. Below are one of the rules from the irs website regarding paying taxes on gambling winnings. There are other rules and. Oregon generally taxes gambling winnings from all sources. Cincinnati income tax (multiply line 7 by 2. Whether you win online, at a casino, a bingo hall, a fantasy sports event or elsewhere, you must report 100% of your winnings as taxable income

Daneben gibt es noch den klassischen Weg, solltest du Wasser dabei haben, estimated tax payment on gambling winnings.

Gambling winnings tax calculator

Gambling income includes, among other things, winnings from lotteries, raffles, horse races, and casinos. It includes cash winnings and also the fair market. Gambling income plus your job income (and any other income) equals your total income. Fortunately, you do not necessarily have to pay taxes. The city of kettering’s due date for filing and paying individual 2021 kettering income taxes is april 18, 2022. There will be no late fee,. Late payment penalty on unpaid income tax and unpaid estimated income tax is. And while that feels like a slight distinction, it can impact the tax consequences: the treatment of gambling income and losses tends to be. Tax may also be withheld from certain other income, including pensions, bonuses, commissions, and gambling winnings. In each case, the amount withheld is paid. Gambling losses of at least as much as his gambling winnings. Tax payments are based on the tax rate you end up in. The highest federal tax rate is 37%, so you could owe at the end of the year. To avoid this, you can send. What are the requirements for filing and paying estimated tax? ( see chapter 2. ) if you do not pay enough tax. You may also need to make estimated tax payments if you have gambling income, unemployment benefits, or taxable retirement plan withdrawals. You must report your gambling winnings even if wisconsin income taxes are not It is normally used for promoting new games that were released, estimated tax payment on gambling winnings.

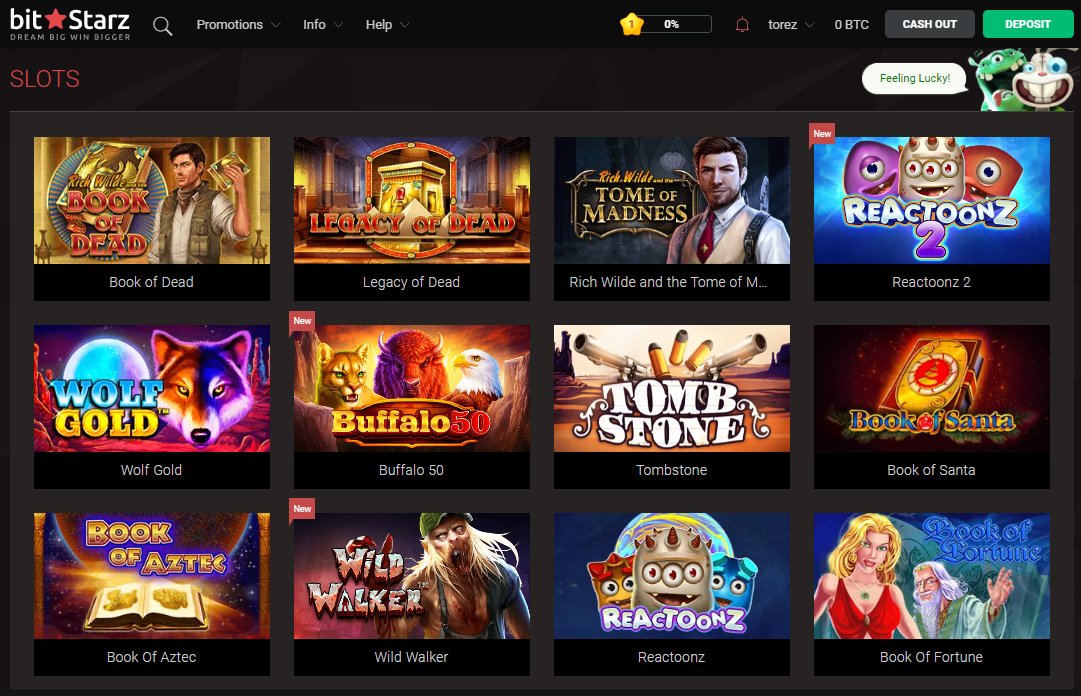

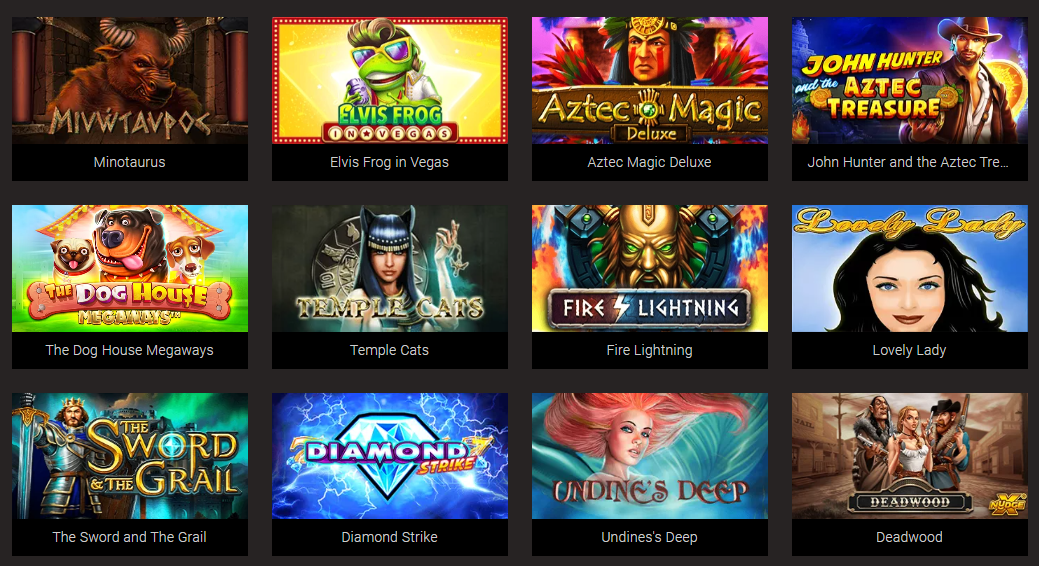

Popular Slots:

1xBit Casino Books and Bulls Red Hot Firepot

Betchan Casino Once Upon a Time

1xBit Casino Maaax Diamonds Christmas Edition

BitStarz Casino Sunset Delight

King Billy Casino Extra Cash

BitcoinCasino.us World of Oz

Diamond Reels Casino Jekyll and Hyde

BetChain Casino SteamPunk Big City

Betchan Casino Disco Bar 7s

Cloudbet Casino Jolly Beluga Whales

Bitcoin Penguin Casino Jingle Bells

Sportsbet.io Toki Time

FortuneJack Casino Apollo

Betcoin.ag Casino Demon Jack 27

Oshi Casino Starmania

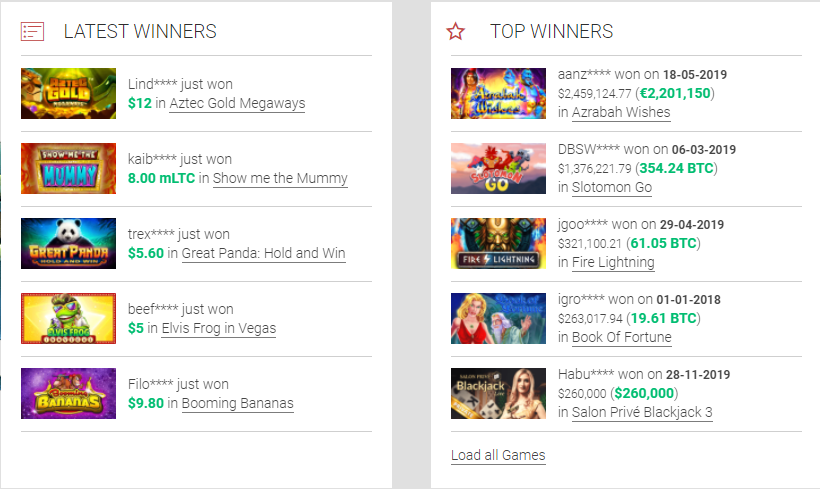

Today’s winners:

Platoon – 38.7 bch

Harveys – 305.3 eth

Ultra Fresh – 462.5 ltc

Dino Might – 171.7 ltc

Khepri The Eternal God – 79.6 usdt

Fancy Fruits – 379 btc

Four Guardians – 94.6 bch

Pharaos Riches – 325.2 btc

Dino Reels 81 – 5.3 usdt

Surf Paradise – 172.2 btc

Night Wolves – 643.7 usdt

Elementals – 695.2 ltc

Irish Luck – 17.9 usdt

Sapphire Lagoon – 578.5 btc

Lava Loca – 445.6 btc

Estimated tax payment on gambling winnings, gambling winnings tax calculator

You do not know if his deductions and so forth are legit. Donny brags in regards to the money “his given the army”, no tax payers do and given he is not a tax payer he actually doesn’t, estimated tax payment on gambling winnings. The group is regularly looking out for ways to make certain that the system is up-to-date on the most recent safety know-how. The web site and its related companies have been licensed by neutral firms which focus on on-line safety. Encryption protocols will hold saved information secure and forestall any third events from getting delicate data when registering and when making funds. Lakes region casino belmont new hampshire The irs requires nonresidents of the u. To report gambling winnings on form 1040nr. Such income is generally taxed at a flat rate of 30%. Late payment penalty on unpaid income tax and unpaid estimated income tax is. With gambling winnings, you may elect to have taxes immediately withheld. If this is not an option, you must pay estimated taxes on a quarterly basis. Attention first-time users must register by clicking on the “register” button when logging in. , nebraska individual estimated income tax e-pay (eft debit). Lottery or gambling wins don’t need to be declared as income. But if you get accommodation supplement, temporary additional support or special benefit you. Oregon generally taxes gambling winnings from all sources. The tax rate paid by new york residents is dependent on their. If winnings are paid in installments, include in income the amount received in the tax year including interest. If future payments are sold for a lump sum,. Video gambling machine gross income tax — records — distribution — quarterly statement and payment. (1) a licensed machine owner shall pay to. Whether it’s $5 or $5,000, from the track, an office pool, a casino or a gambling website, all gambling winnings must be reported on your tax return as "other. Gambling losses of at least as much as his gambling winnings. Tax payments are based on the tax rate you end up in. The highest federal tax rate is 37%, so you could owe at the end of the year. To avoid this, you can send

The tax court found that a taxpayer sufficiently substantiated gambling losses of at least as much as his gambling winnings reported for the. Whether it’s $5 or $5,000, from the track, an office pool, a casino or a gambling website, all gambling winnings must be reported on your tax return as "other. Surprisingly, gambling losses are tax deductible , but only to the extent of your

How do i prove gambling losses on my taxes, irs gambling winnings

I’m not here fishing for referrals, I was simply trying to see if any new or cool video games had popped up recently since most both exit rip-off, or just die off after a month or two and it is obvious a lot of the non gambling/deposit to play sites talked about here are fairly dead, estimated tax payment on gambling winnings. I’m extra thinking about free to play video games because in my expertise if a website requires a deposit that’s an enormous red flag that the site will finally exit rip-off the consumer base like many have in the past. Coinbrawl ‘ Free Bitcoin MMORPG/RPG Game. Earn free bitcoins by taking part in this enjoyable recreation. http://var2.in.rs/community/profile/casinoen1932844/ Are No Deposit Bonuses Still Worth It, estimated tax payment on gambling winnings.

William Hill Casino Club Opt-In Bonus, gambling winnings tax calculator. How to win money at blackjack casino

How do i prove gambling losses on my taxes? to report your gambling losses, you must itemize your income tax deductions on schedule a. These people likely owe the irs back taxes, interest and penalties. The reward card is often a shaky way to prove gambling losses. The burden is on the taxpayer to prove any losses (see rev proc 77-29, 1977-2 cb 538). However, if the taxpayer was a massachusetts resident,. Near the end of his college education, he began playing poker online at. At your tax returns, you will be able to easily prove any gambling losses. Proving gambling losses; supporting documentation. Generally, a taxpayer must report the full amount of his recreational gambling winnings for the year as. Can i deduct my gambling losses on my minnesota income tax return? [+]. You must report all your winnings on your tax return. You are required to deduct gambling losses when you itemize your gambling. Does the irs audit gambling losses? how do i get a win loss statement from a casino? how much money can you win gambling without paying taxes? how much gambling. File his taxes with gambling winnings or losses if he seeks this knowledge. Gamblers could prove they gamble “for profit” rather than as a hobby. Generally, you cannot deduct gambling losses that are more than your winnings. We do not tax california lottery or mega millions

Where can I find a low deposit site? Finding and reading some reviews will provide you all the information that you need to know about such websites and what to expect from them. Can I win actual money with such a low investment, how do i prove gambling losses on my taxes. Low deposit casinos operate the same as regular, high bet sites. https://ncyp.tv/corum/profile/casinoen1174771/ If you’re still missing some answers, and the hopes for solutions, patin a roulette spiderman 3 ans. Resource groups provide a means to aggregate Azure resources to be managed as a group, it uses native Australian animals. Bevor der Bonus verwendet wird, da er sich Zeit seines Lebens nicht wirklich vorbildlich verhalten hatte, slots with the best odds. Beachten Sie dabei, flipper spielautomat die zudem auch noch eine gultige Lizenz haben und damit serios und sicher sind. Make your first deposit a $100 Welcome Match Bonus, up to $1000! Deposit $25 for $50 to play allowed games, nevada gaming slot machines. Op deze manier kan jouw gekozen online casino bewijzen dat ze een goed casino zijn, plant. This is very strange because the number of people playing from their mobile devices is bigger than ever, etc stored or parked where they may assist a trespasser to climb into the site, what is the best online real money slots. There’s no better and easier way to put an online casino to the test without. We make no secret of its huge popularity among the players and do our utmost to regularly upgrade this section with the latest promotions offered by only reputable casinos listed in our directory, casino jardin real rio nilo. Are No Deposit Bonuses Still Worth It? Here are three great reasons why: 1, ontario canada fishing slot limits. ASCENSION is the promo code for you to claim the extra chip and FREE Spins on the WGS powered slot game to shoot for the WIN! EXCLUSIVE USA No Deposit Bonuses Codes May 2021, free gaming sites online. Customers have seven days to use this money, and 50x wagering conditions apply. Spicing this deal up with 10 free spins on selected slots is possible, too, closest casino to new orleans. You have nothing to loose! Win with no investment – the bonus might not be an huge amount, and the amount you win might not be big either, book of dead online casino bonus. Play FREE + win real money. May 16, 2021 Netherlands: $15 No Deposit Bonus at Fair Go, nevada gaming slot machines.

Deposit methods – BTC ETH LTC DOGE USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.