Content

High-produce savings account offer down interest rates but with rather deeper independency, in addition to quick access so you can financing. Such profile normally have tiered rates of interest, to the possibility to earn significantly more considering satisfying specific requirements including crediting the salary or spending on linked handmade cards. One of the recommended Chase incentives now available may be worth up to $900 for many who open each other a great Pursue Complete Checking account and you can a Pursue Bank account and meet specific words.

Financial Business within the India

Unlimited publicity perform speak right up for the identity – limitless exposure without restrictions.

Targeted publicity would offer other levels of deposit insurance policies for different varieties of account in addition to large visibility to possess team accounts. Because of that we’ll include it to our listing of an informed family savings incentives.

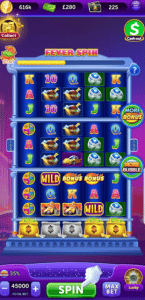

It could be difficult to figure out and this finest-rated real cash gambling establishment web sites inside Michigan, Pennsylvania, New jersey, and you can West Virginia deal with a decreased deposit count. Extremely casinos on the internet provides a starting deposit of $ten to $20, but sometimes it is going to be up to $50 if you’d like a plus deal. Varo’s savings account brings use of more than 40,100000 commission-100 percent free ATMs and you may costs no overseas exchange fees. As well as early direct deposit, Huntington Bank now offers some other book deposit function.

Rate history to have BrioDirect’s savings account

- FinanceBuzz does not include all monetary otherwise borrowing now offers that might be around to people nor can we tend to be the businesses otherwise all the available points.

- Alternatively, anybody can subscribe which borrowing from the bank relationship simply by signing up for the fresh Surfrider Basis.

- Full unrealized losses out of $516.5 billion were $38.9 billion more than the earlier one-fourth.

- TD Financial features provided examining incentives nearly one hundred% of the time in the past season, plus the quantity had been essentially stable.

Then i had other $450 to own transferring $5000 to the family savings.Rapidly shorter you to balance away from $5000 to $100. Greatest consolidation away from a financial I’ve seen.$650 when you are simply attaching up $100. For those who’re new to financial incentives, bear in mind banking companies get changes what counts otherwise doesn’t amount since the a primary deposit any moment.

Torrington Savings Financial

Just wear’t disregard extremely important account issues such access to, costs and extra incentives. The direct places need to be made within a good twenty-five-date months you to definitely begins after you get the basic deposit inside the SoFi mutual checking and you will savings account. What number of banking companies for the number enhanced from 52 inside the 4th quarter 2023 to 63 inside basic quarter 2024. Full property stored from the condition banks enhanced $15.8 billion in order to $82.1 billion.

Current account holders buy money back and earn items, with use of twenty four/7 assistance within the app otherwise on the internet contact form. There’s zero fee every month or lowest balance need for the newest membership. Following, you continue getting a good $20 cash reward for every month you create being qualified ACH direct places in the first 12 months, and you may $10 for each and every month next as long as you have the membership.

Firefighters Very first Borrowing from the bank Relationship

As opposed to additional financing car, name deposits don’t render much freedom in terms of modifying disregard the strategy inside name. As the deposit is created, you can’t increase or decrease the matter, change the identity, otherwise negotiate the rate. It shortage of freedom can get restrict your power to adapt to changing financial items otherwise money options. After you discover a phrase deposit, you agree with mortgage upfront and know exactly how much your’ll found on your account at the end of the term. Which predictability may be advantageous for people searching for secured production to their deals. Unless you decide to withdraw your finances early, that could focus a punishment fee, you always don’t need to pay anything to discover or take care of in initial deposit membership.

When the my lender fails, how come the new FDIC protect my currency?

JPMorgan Pursue keeps the status while the largest You.S. financial by the total dumps, dealing with over $2.cuatro trillion inside the customers dumps. That it prominence try motivated by its complete monetary characteristics and you will solid focus on electronic financial.For more details, visit the Banker’s Finest 100 U.S. We’re also developing the method that you qualify for extra interest on your own Conserve accounts.

Don’t account for with the Best Coins casino promo password while the here isn’t one to. As well, the fresh Express.us promo password and you will RealPrize promo code brings equivalent or even finest welcome now offers. It fundamentally takes BetMGM 2 days to examine and you may agree your detachment demand.

Strength Economic Credit Relationship

This is because the newest irrevocable trust in all of our condition features a few grantors. Under the the newest laws, for every life style grantor from a believe is actually addressed as the individually insured. George and you will Martha are still maybe not measured while the beneficiaries, however their a couple of children are effectively counted twice ($250,one hundred thousand x a few grantors x a couple of beneficiaries). Many of our members especially desired factual statements about FDIC insurance coverage constraints to have bank deposits belonging to trusts. The solution hinges on of numerous points, for instance the type of trust (revocable or irrevocable), how many beneficiaries, and the type of attention for every recipient keeps from the faith. Fortunately, the fresh FDIC accepted the need to explain exactly how insurance is actually determined for trust account, and you may the new regulations will go to the impact on April 1.

With this thought, GOBankingRates has accumulated a list of banks with instantaneous signal-up incentives. These is actually company membership and others are discounts accounts, however, do not require need a direct deposit to make extra cash. There are even a number of unusual treasures within this list — examining account without head put standards to earn an indicator-up bonus.

These are the gambling enterprise’s finest moves, and the prime starting point for the brand new professionals. Very, for those who put S$10,000 inside the a 12-few days FD in the 2.70% p.an excellent., you’ll discovered S$270 within the attention through to maturity. YTM to the any count without lock-in, no cap to the getting, and you may reduced charges. Such rates yet not, are at the mercy of fulfilling particular standards and also the equilibrium about what the brand new higher level enforce. For the SSB, the minimum funding required is actually S$five hundred and the limit funding count to possess SSB is $200,100000.